Last week’s JAKOTA markets:

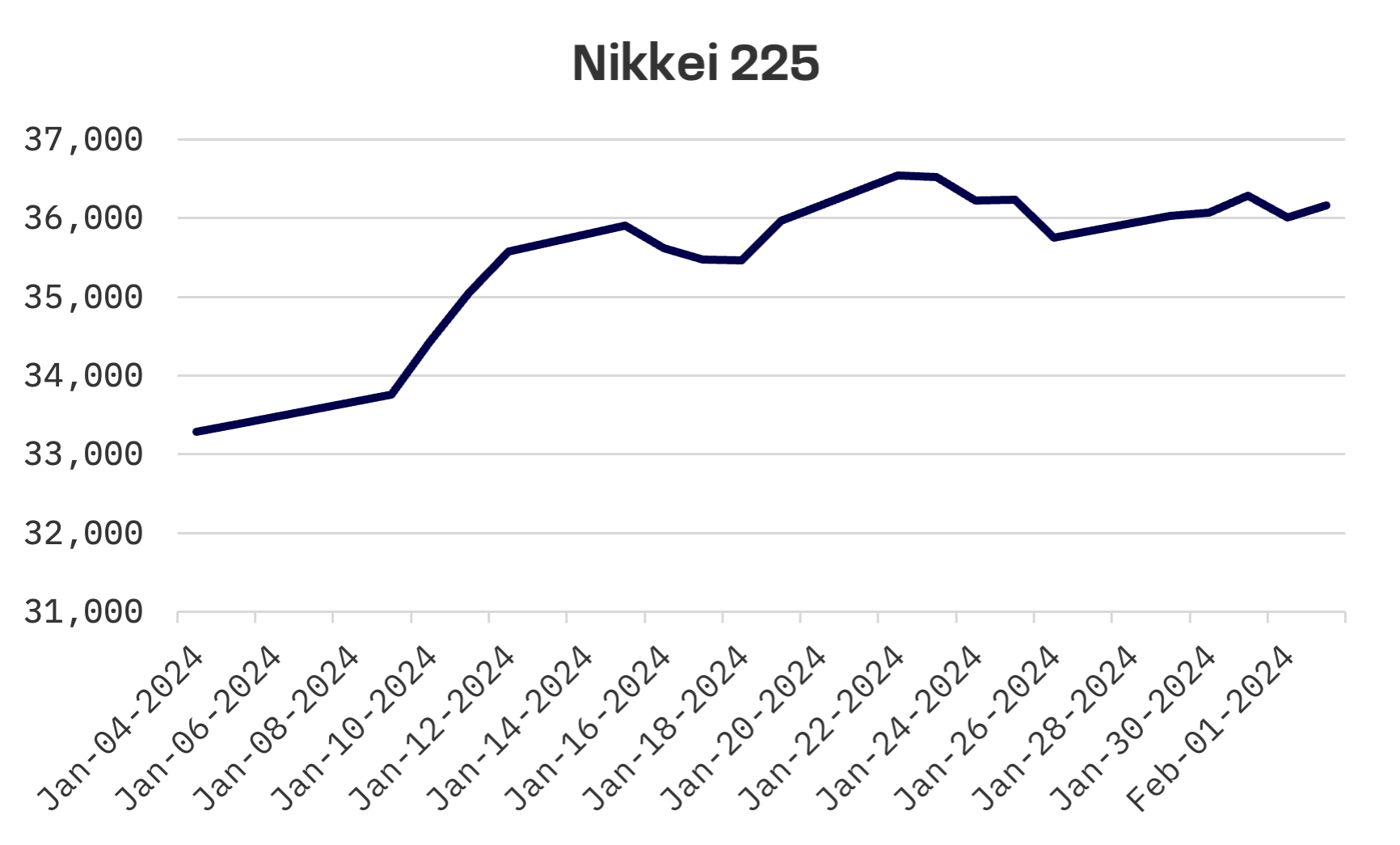

- Japan’s Nikkei 225 Index experienced a notable uptick, rising 1.1%, buoyed by strong corporate earnings and tourism that significantly benefited domestically oriented companies

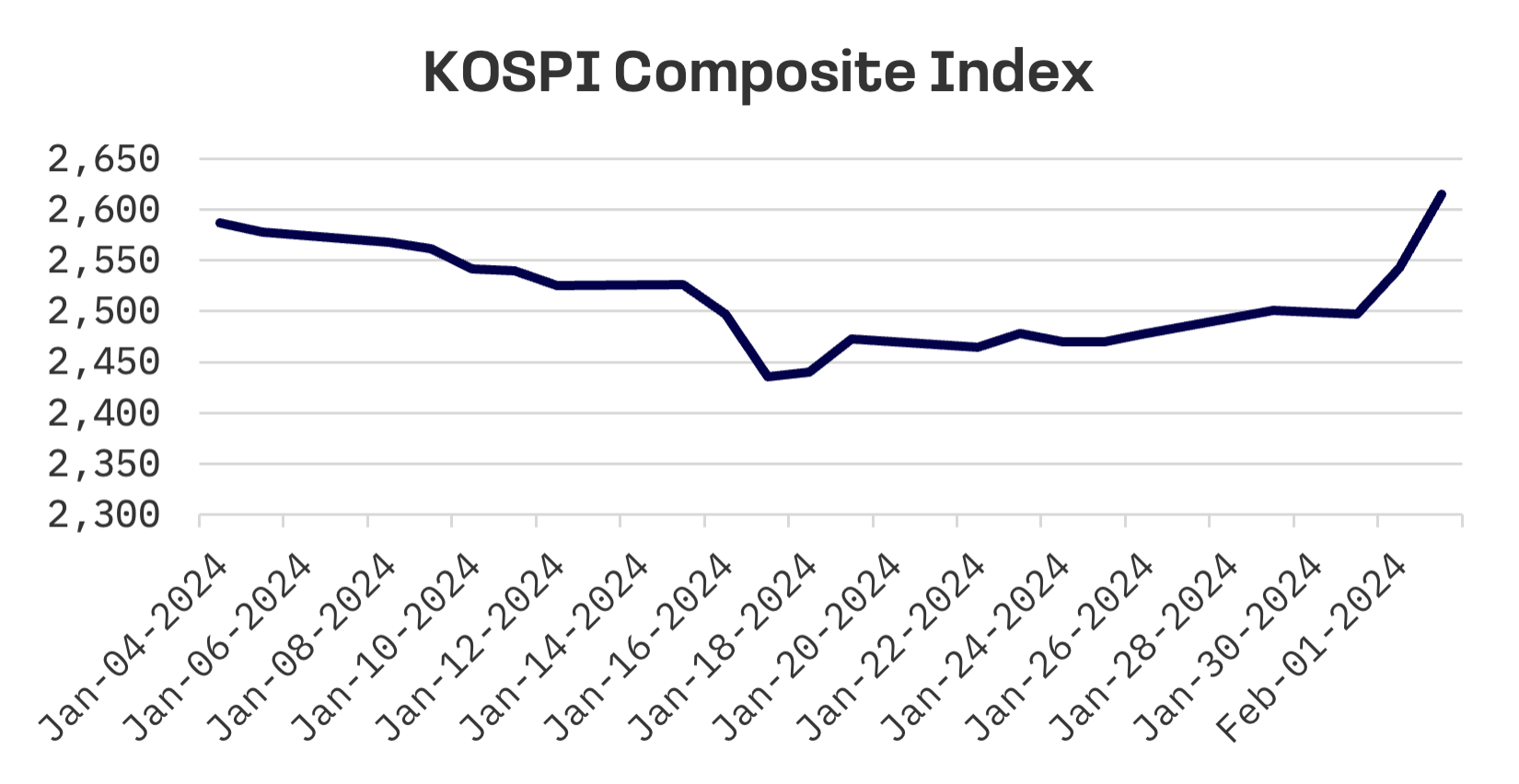

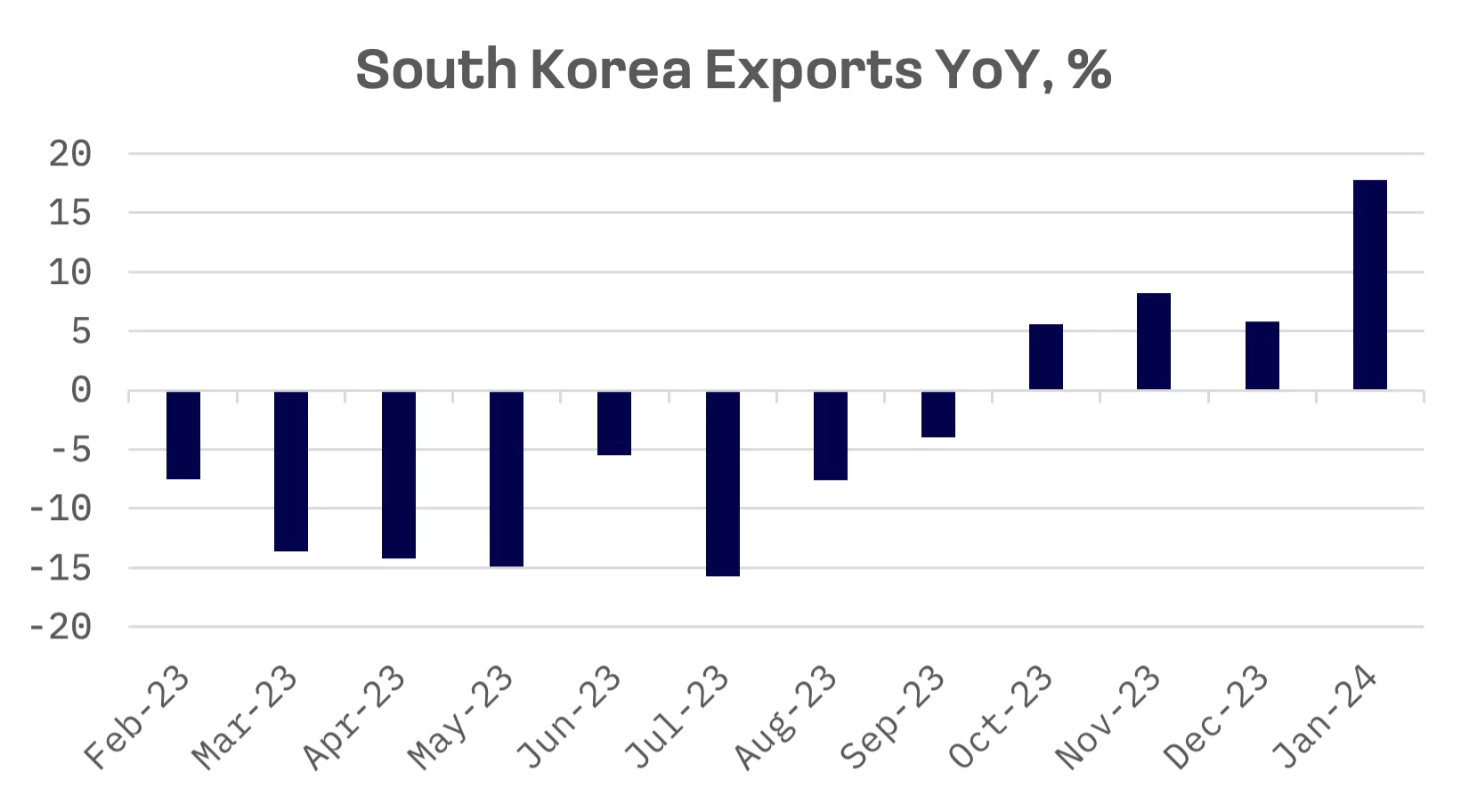

- The KOSPI in South Korea recorded a significant 5.5% increase, its best performance since November 2022, thanks to a buoyant tech sector and encouraging export figures

- Taiwan’s TAIEX index saw modest growth, inching up by 0.36%, as investor reactions to U.S. Federal Reserve policy meetings and tech sector guidance resulted in a week of mixed sentiments

- The JAKOTA Blue Chip 150 Index advanced 1.7%, reflecting the upward momentum in South Korean stocks against a backdrop of varied sectoral performances

Japan

The Japanese stock markets exhibited an upward trajectory this week with the Nikkei 225 Index climbing 1.1%. The bullish momentum was fueled by a robust corporate earnings season, with higher elevated prices and robust tourism, which notably bolstered domestically oriented companies.

In the Bank of Japan’s (BoJ) Summary of Opinions, a growing confidence was noted among policy board members about nearing the price stability target. The document underscored an increasing momentum towards fostering a virtuous cycle between wages and prices, with particular emphasis on the expectation of wage hikes across small and medium-sized companies and a sustained high rate of increase in service prices.

Furthermore, the Summary suggested that after a detailed assessment of the macroeconomic impacts of the Noto Peninsula earthquake over the forthcoming one or two months, the BoJ might reach a point where normalization of its monetary policy becomes viable. Despite the potential cessation of negative interest rate policies, it is expected that accommodative financial conditions will persist.

Economic data showed the Purchasing Managers’ Index (PMI), as compiled by au Jibun Bank, marginally increased to 48.0 in January from 47.9 in December, still below the critical 50.0 threshold which separates expansion from contraction. Manufacturers reported a notable rise in price pressures during the month, attributed to increased costs for raw materials, labor and fuel. Meanwhile, the yield on the 10-year Japanese government bond (JGB) fell to 0.68% from 0.71%, a decrease attributed to a strong demand at the 10-year JGB auction, putting downward pressure on yields.

South Korea

The South Korean stock market enjoyed a significant boost this week, with the KOSPI Composite Index leaping by 5.5%, marking its most substantial one-week percentage gain since November 2022. The surge was propelled by the robust performance of the technology, automotive and financial sectors, along with encouraging export statistics. Exports continued their upward trajectory for the fourth consecutive month, buoyed by strong earnings reports from major U.S. technology companies.

January saw South Korean exports kick off the year with vigour, driven by a revival in semiconductor shipments and strong demand from China, indicating that Asia’s fourth-largest economy might be performing beyond earlier projections.

Data released by the Ministry of Trade, Industry and Energy revealed that outbound shipments in January rose by 18% year-over-year, reaching $54.69 billion. This marked the first instance of double-digit growth in 20 months and the fourth consecutive month of export increases.

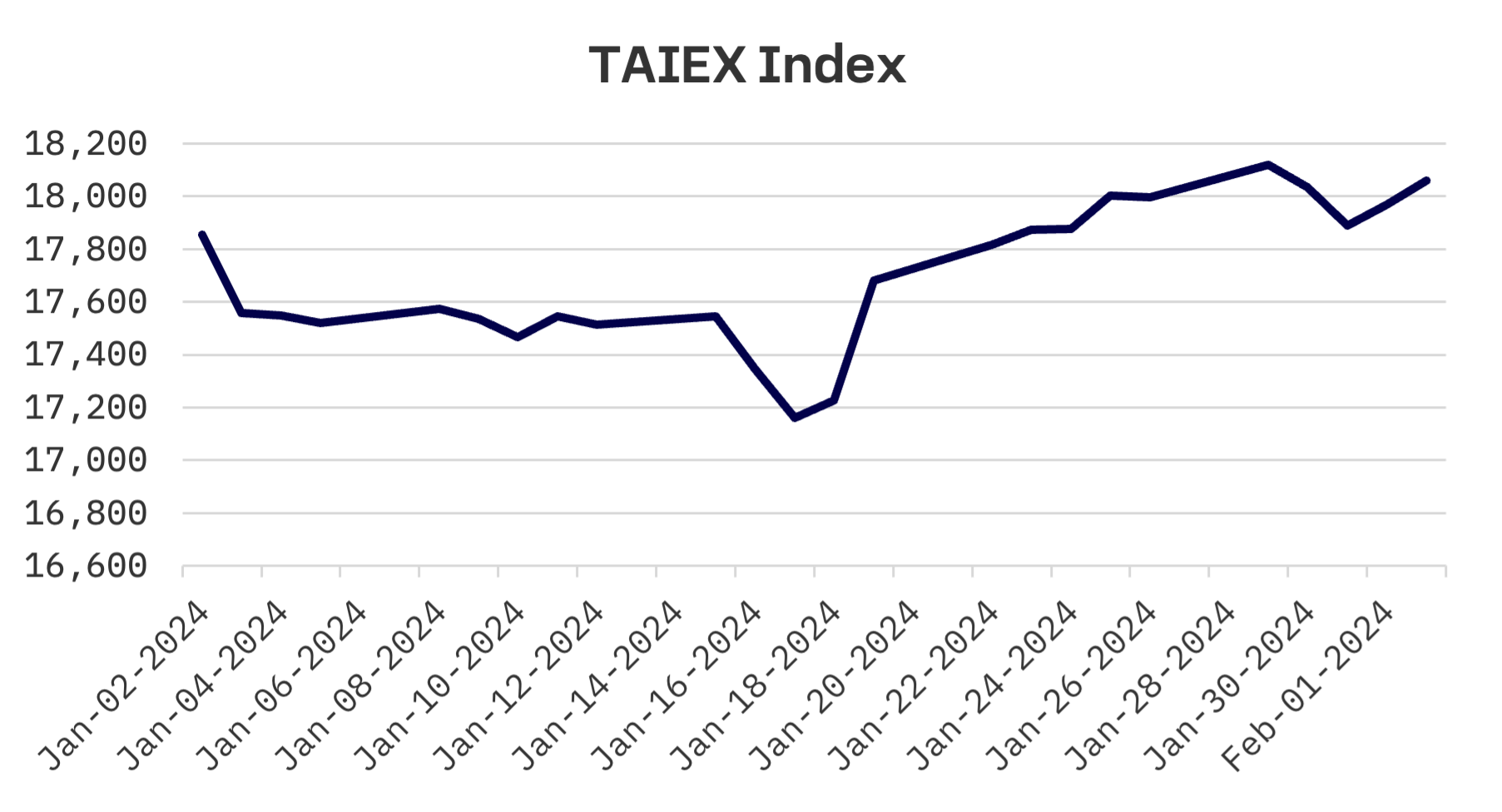

Taiwan

Taiwan’s stock market displayed a modest gain of 0.36% this week, marking a contrast to its previous outperformance against Japanese and South Korean markets. The market experienced volatility, beginning the week on a strong note but subsequently seeing a pullback as investors took profits ahead of the U.S. Federal Reserve’s two-day policy meeting.

The volatility persisted into Wednesday, particularly within the electronics sector, following Advanced Micro Devices’ (AMD) announcement of lower-than-expected sales guidance for the first quarter. Nonetheless, the market rebounded in the latter half of the week, thanks to a recovery in Taiwan Semiconductor Manufacturing Company (TSMC) shares, which helped uplift broader market sentiment.

On the economic front, Taiwan’s manufacturing sector remained in contraction for the 11th consecutive month, according to the Chung-Hua Institution for Economic Research (CIER). However, there was a slight improvement in the sector’s condition from the previous month, with the January PMI increasing by 1.2 points to 48.0. CIER noted a third consecutive month of recovery in the sub-index measuring business outlook.

JAKOTA Blue Chip 150 Index

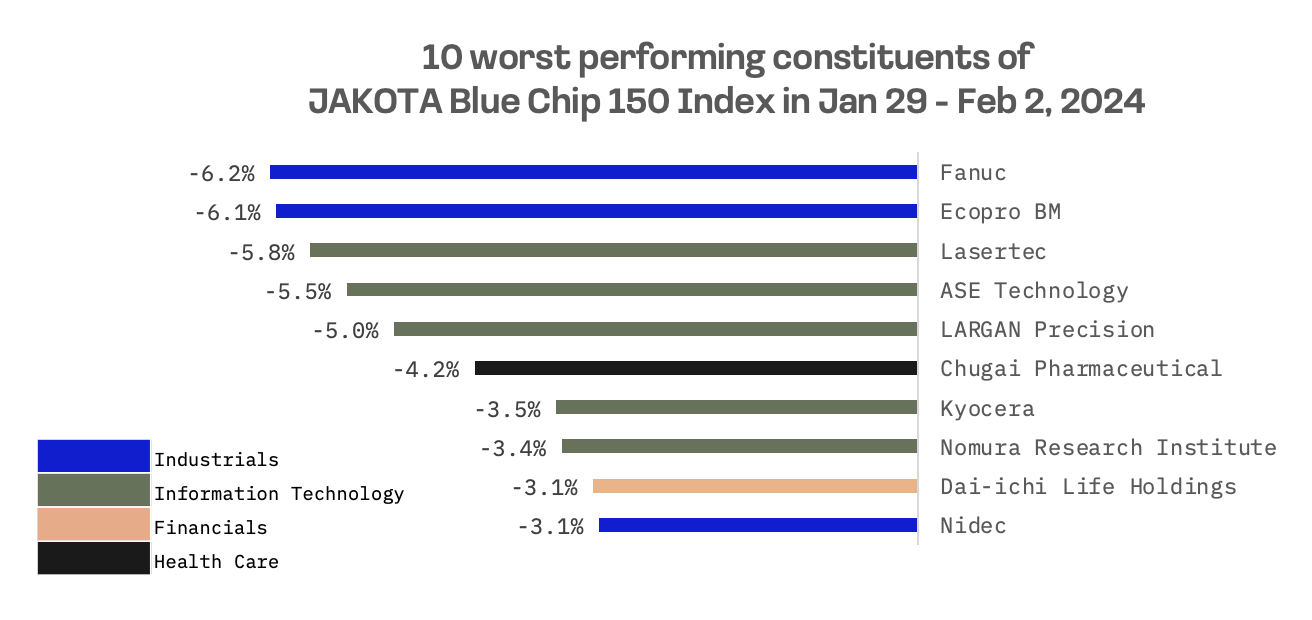

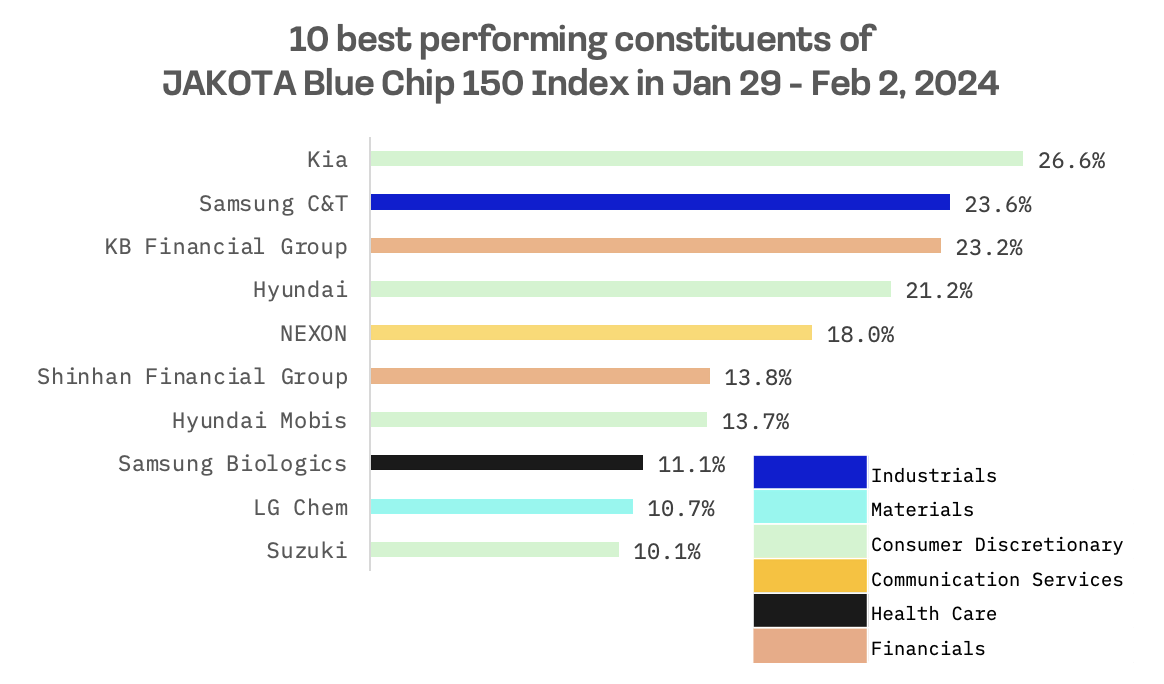

The JAKOTA Blue Chip 150 Index jumped by 1.7% this week mainly driven by strong performance of South Korean stocks. Of the 150 constituents, 69 stocks showed positive price trends.

South Korean companies, notably KB Financial Group and Shinhan Financial Group, were among the top performers. Kia Motors, an automobile manufacturer, led the gains, buoyed by news of a 24.8% surge in South Korean car exports last month, reaching $6.2 billion, the highest level for any January.

Ecopro BM, a battery materials manufacturer, faced pressure but saw its position as the worst-performing stock in the JAKOTA Blue Chip 150 Index overtaken by Fanuc, a manufacturing automation supplier. Fanuc reported a 24.0% decline in consolidated ordinary profit for the third quarter of the fiscal year ending March 2024, compared to the same period last year, totaling 135.1 billion yen. However, the company revised its full-year profit forecast upwards by 9.3%, from the previous estimate of ¥153.3 billion to ¥167.6 billion, mitigating the anticipated rate of profit decline from 33.7% to 27.5%. Initially, the market responded positively to these results, but Fanuc’s shares later retreated, ending the week 6.2% lower.