Last week’s JAKOTA markets:

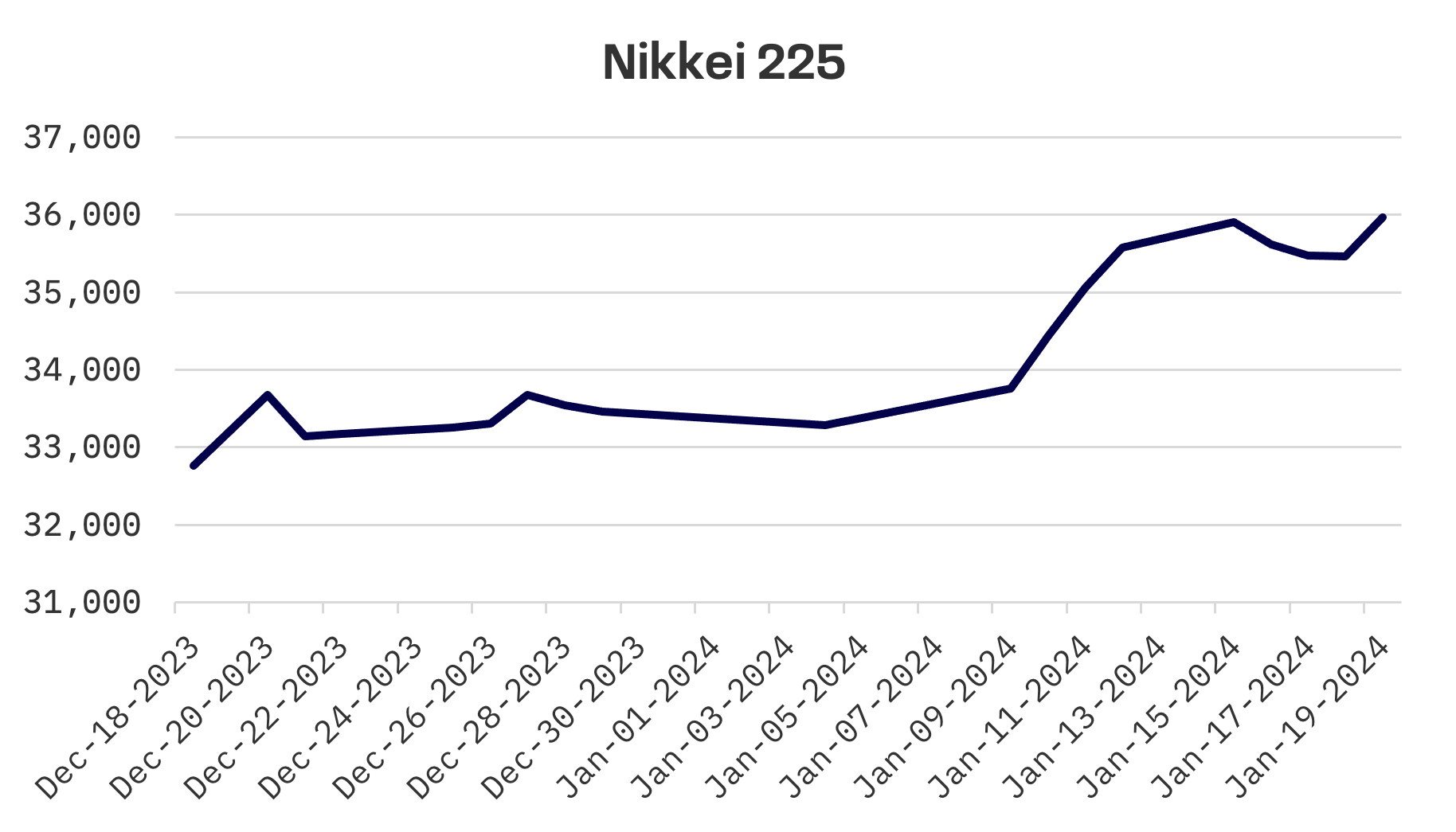

- Japan’s Nikkei 225 Index climbs 1.1%, reaching a 34-year high amid yen weakness and steady BoJ policy

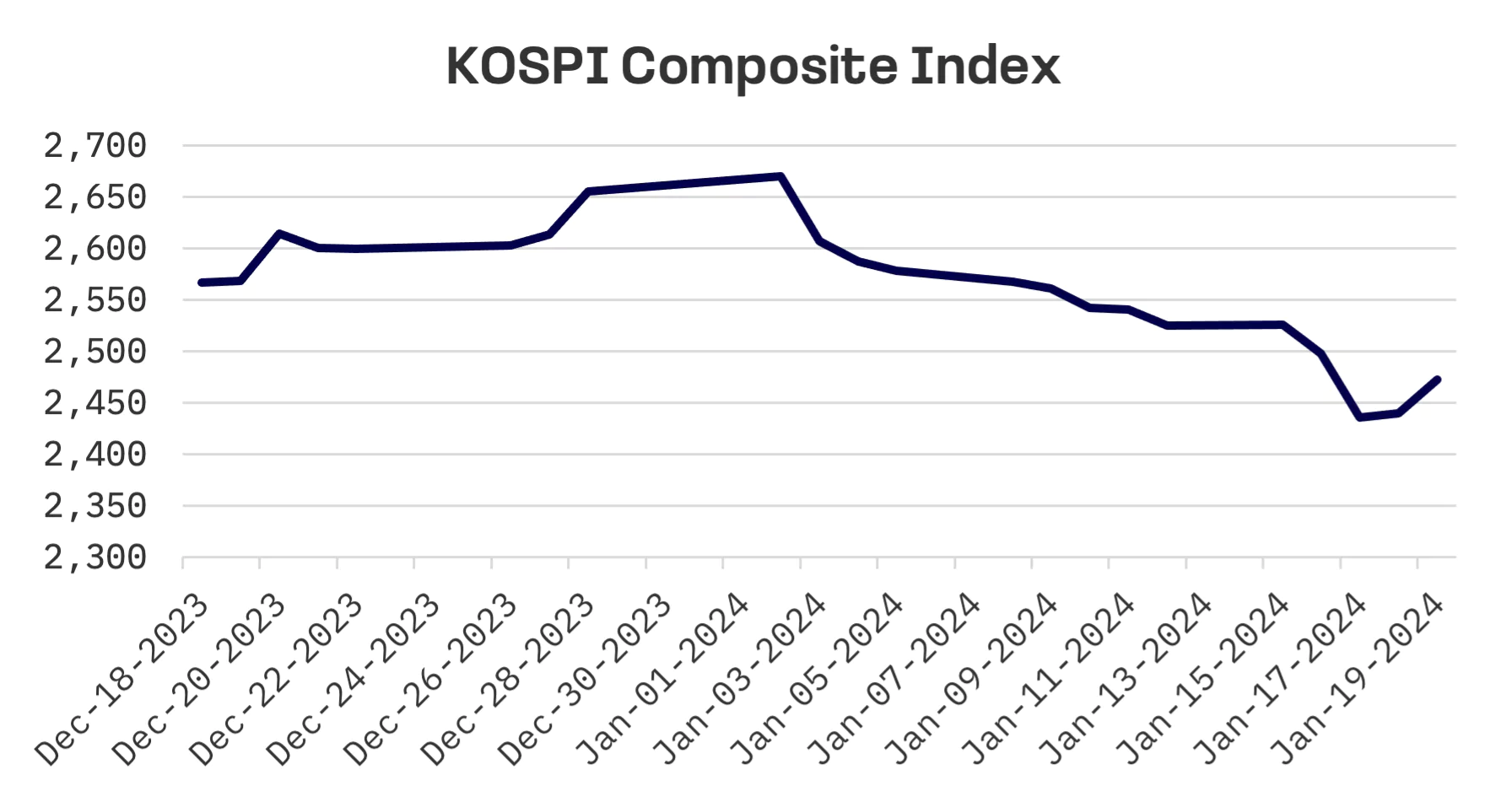

- South Korea’s KOSPI faces a 2.1% decline, influenced by global market dynamics and cautious central bank stances

- Taiwan’s TAIEX index sees modest growth of 1%, reflecting mixed investor sentiment, post-presidential election

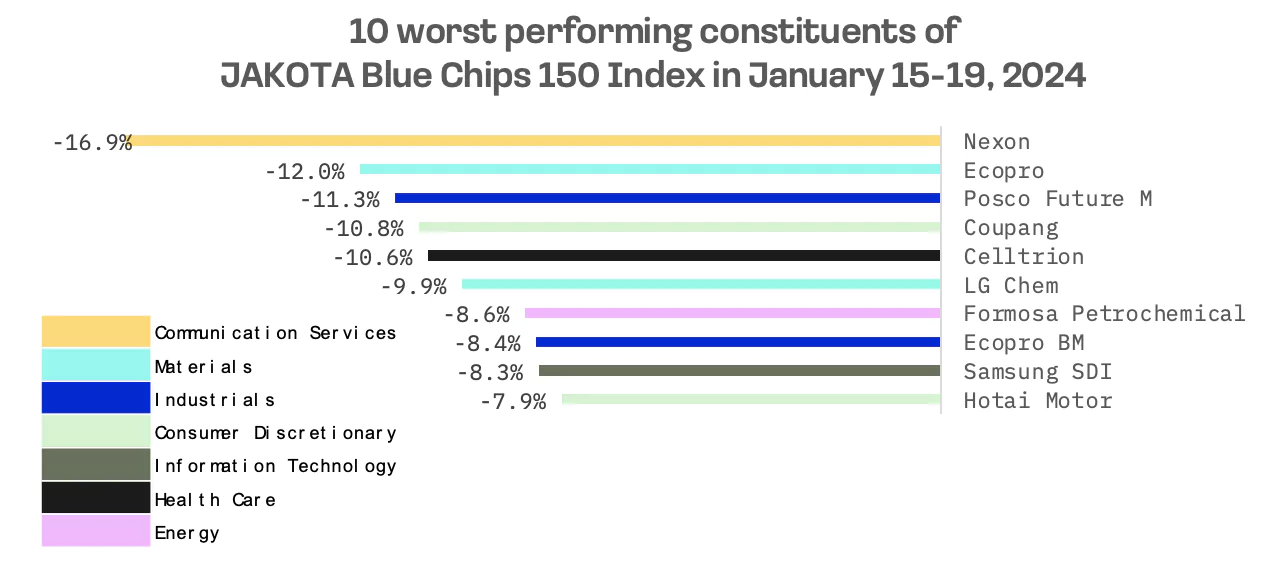

- The JAKOTA Blue Chip 150 Index experiences a 1% dip, with standout performances from Advantest and downward trends led by Nexon

Japan

Japan’s stock market witnessed a notable gain this week, with the Nikkei 225 Index rising by 1.1%, reaching a peak not seen in 34 years. The market’s buoyancy was fueled by the yen’s weakness, which proved beneficial for exporters, and diminishing inflationary pressures, dampening expectations of a shift in the Bank of Japan’s (BoJ) monetary policy at its upcoming January meeting.

The possibility of the Bank of Japan (BoJ) exiting its negative interest rate policy in the near term was already seen as unlikely due to the economic impact of the deadly earthquake that hit Japan’s Noto Peninsula on New Year’s Day. This event, coupled with other factors, has contributed to shaping a positive trajectory for the Japanese stock market over the week.

As prospects of an immediate interest rate hike in Japan faded, the yen experienced a weakening trend, settling at around JPY 148 against the U.S. dollar, a notable change from the previous week’s high-144 range. This rapid depreciation of the yen prompted Finance Minister Shunichi Suzuki to intervene verbally. Suzuki highlighted the government’s close monitoring of currency movements and stressed the importance of stable currency fluctuations that accurately reflect economic fundamentals.

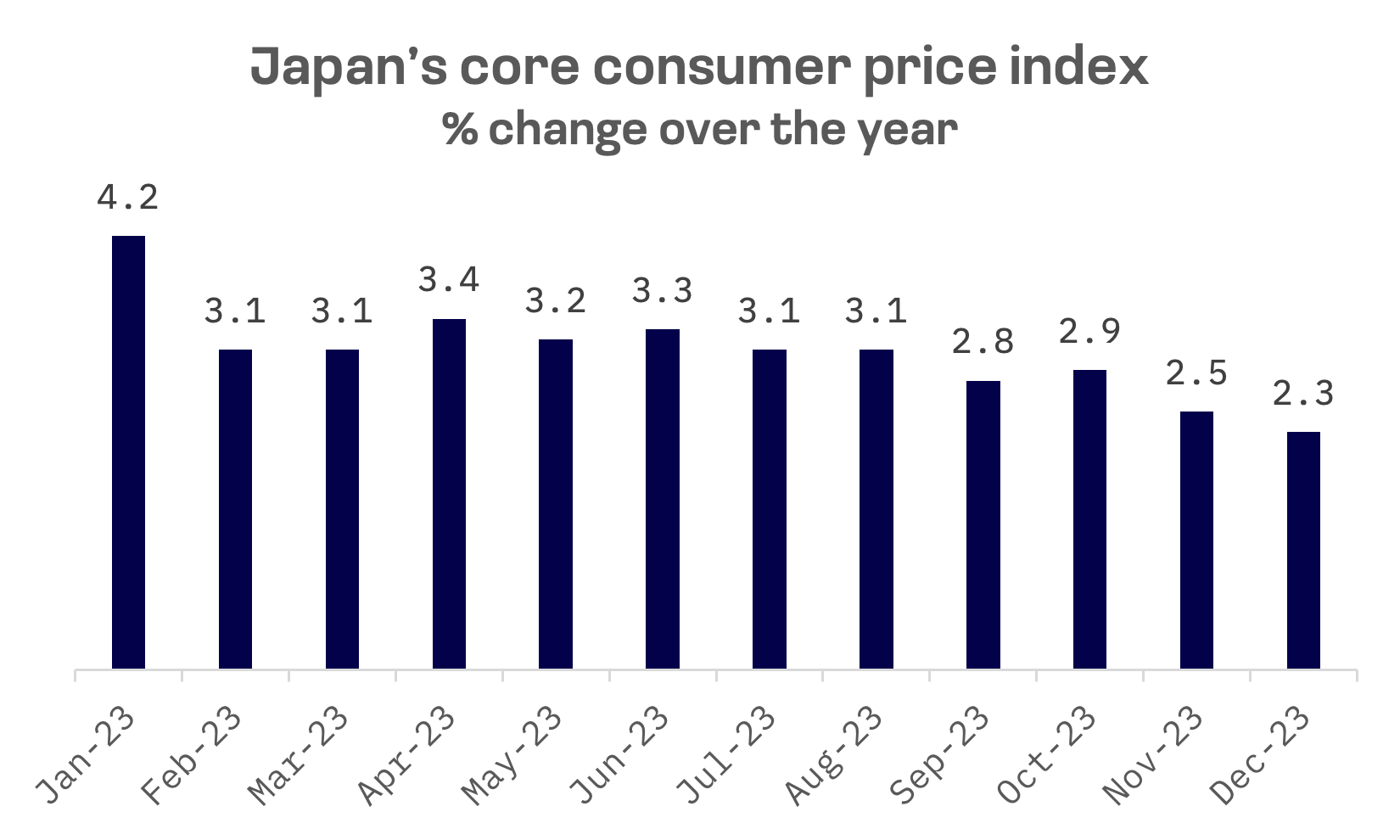

Japan’s core consumer price index (CPI) recorded a year-on-year rise of 2.3% in December, a slight drop from November’s 2.5%, making it the lowest rate since June 2022. Despite aligning with the CPI forecast, this figure has prompted some investors to rethink their expectations of multiple interest rate hikes by the Bank of Japan (BoJ) in the upcoming year. The BoJ has consistently maintained its position on keeping an ultra-accommodative monetary policy until there is a sustainable increase in inflation, primarily driven by wage growth.

However, the significant deceleration in headline wage growth seen in November has led many investors to anticipate that the BoJ may wait for additional data before considering any changes in its policy direction. This includes the outcomes of the “shunto” wage negotiations, set to take place between large corporations and unions in March, which could potentially influence the central bank’s stance on monetary policy adjustments.

South Korea

South Korea’s stock market has continued its downward trajectory, as indicated by a 2.1% drop in the KOSPI Composite Index. In the first 14 days of trading, the index experienced declines on 10 of those days, marking a notably disappointing performance compared to other major global markets.

This negative trend in the South Korean market is attributed to several factors: diminishing expectations for an early interest rate cut by the U.S. Federal Reserve, lacklustre corporate performance and escalating geopolitical tensions in the JAKOTA region, primarily around the outcome of the presidential election in Taiwan and China’s reaction to that. These elements have collectively led to increased institutional selling, with some analysts speculating that investment funds may be shifting their focus to the Japanese stock market. Although a market correction was somewhat expected following the significant gains at the end of the previous year, the convergence of these adverse factors has had a pronounced impact on investor sentiment, further deepening the market’s decline.

The Financial Services Commission (FSC) has announced plans to abolish a proposed capital gains tax on investments and reduce the stock transaction tax to 0.15% by 2025.

Taiwan

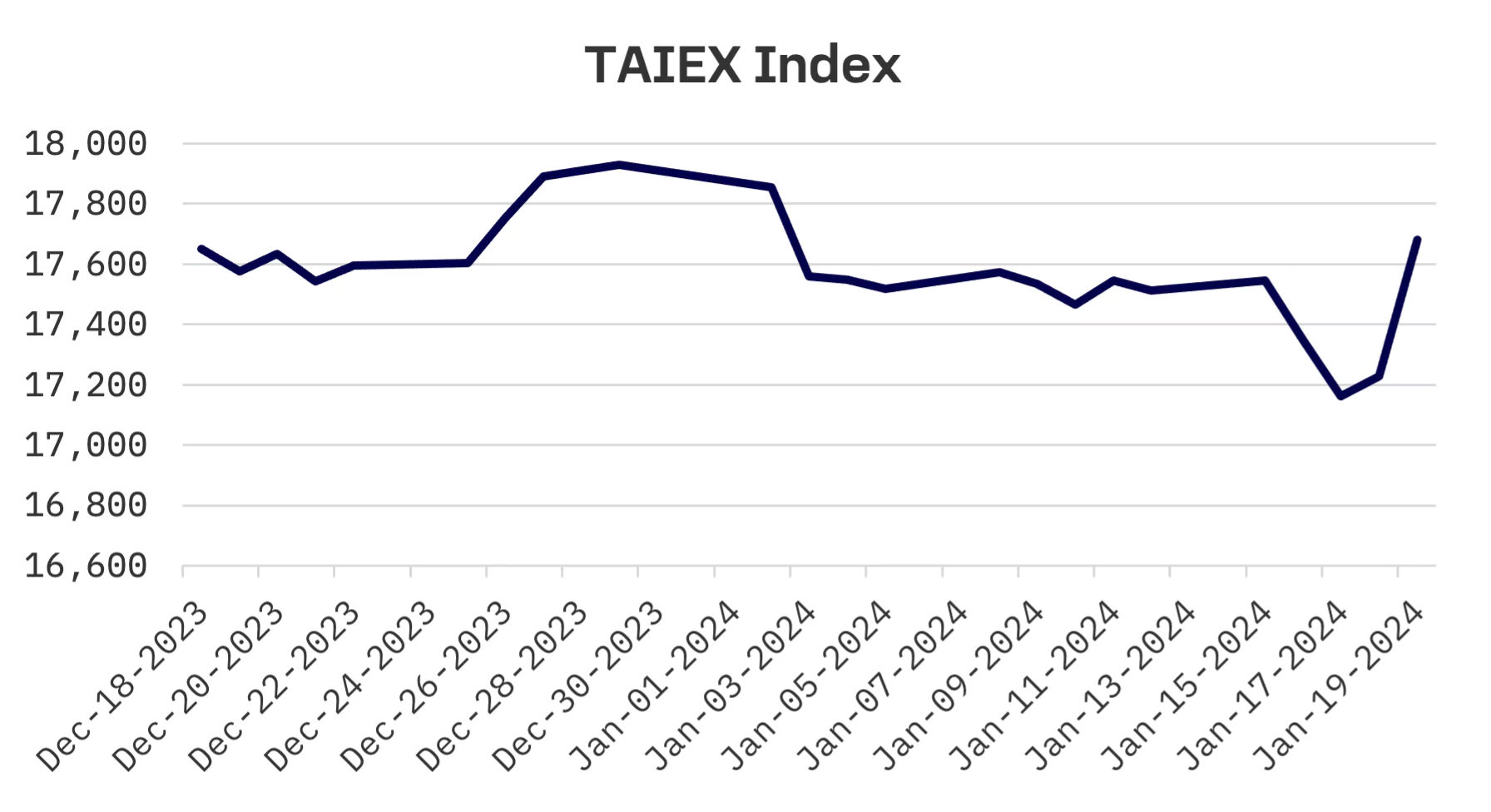

The Taiwanese stock market experienced a week of mixed trends, culminating in a 1% rise in the TAIEX index. The market’s trajectory over the week was marked by multidirectional movements, reflecting the shifting sentiment of investors.

At the beginning of the week, Taiwanese shares closed slightly higher on Monday. This upturn was driven by investor relief following the resolution of political uncertainties after the presidential election over the weekend. However, the subsequent two days saw the market under pressure, with investors exhibiting caution due to uncertainties regarding the timing of potential interest rate cuts by the U.S. Federal Reserve. Despite these mid-week challenges, the market rebounded on Thursday. This was followed by a notable surge of 2.6% on Friday, fueled by strong investor interest in the technology sector.

On Friday, Taiwan’s stock market witnessed significant activity from foreign institutional investors, who recorded net purchases totaling NT$80.1 billion (US$2.55 billion) on the main board. This volume of investment marked the second-highest on record, with a substantial portion of the buying interest centered on shares of Taiwan Semiconductor Manufacturing Co. (TSMC). This surge in investor interest in TSMC came hot on the heels of the company’s announcement the previous day, where TSMC projected a robust growth trajectory for 2024. After a period of decline in 2023, TSMC anticipates its sales to soar by over 20% compared to the previous year, a forecast that has evidently bolstered investor confidence in the company’s prospects for the upcoming year.

JAKOTA Blue Chip 150 Index

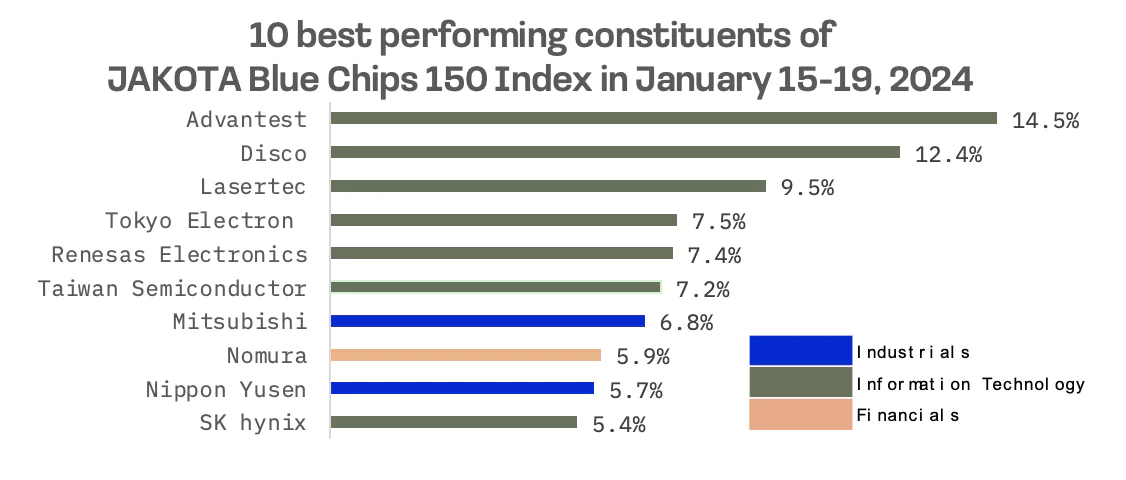

The JAKOTA Blue Chip 150 Index dipped by 1%, with only 67 of its 150 constituents showing positive trends.

Advantest, a manufacturer of automatic test equipment for the semiconductor industry, emerged as the top performer in the JAKOTA Blue Chip 150 Index this week. The company’s stock has been buoyed by sustained buying interest from overseas investors, who are optimistic about a rebound in global semiconductor demand and favorable market conditions. Additionally, a significant boost came from Daiwa Securities, a prominent Japanese investment bank, which upgraded Advantest’s stock from a neutral to a bullish rating. Daiwa Securities’ report underscored the growing demand for semiconductor chips driven by the increasing integration of artificial intelligence in smartphones and PCs. This trend is expected to enhance the demand for System-on-Chip (SoC) testers, further propelling Advantest’s market prospects.

Conversely, Nexon, a video game publisher, experienced a steep decline, leading the downturn among JAKOTA Blue Chip 150 constituents. Nexon’s shares have been under significant downward pressure, plummeting to their lowest levels since early 2024. This decline followed the announcement of new regulatory measures in China aimed at limiting the amount of money and time individuals spend on video games. Adding to its woes, a major U.S. securities company maintained a bearish (sell) rating on Nexon’s stock this week. Moreover, the target price for Nexon shares was revised downward, from JP¥2,700 to JP¥2,300.